Introduction

Over the past few decades, Belgium has struggled with the problem of litter, despite millions being invested in clean-up operations, awareness campaigns and law enforcement (cameras, fines). The Flemish government has set itself the target of reducing litter by 20% by 2022 compared to 2015. In 2021, there were still 18,171 tonnes of litter in Flanders, more than 1,831 tonnes away from this target. That is why Flemish Minister for the Environment Zuhal Demir announced on Friday 23 December that a deposit system will be introduced on all plastic bottles and cans in 2025. She gave the industry the opportunity to launch pilot projects to evaluate the ‘Digital Deposit’ by the end of 2023. If the evaluation of the pilot projects is not positive, both in terms of feasibility and desirability, a traditional deposit system will be introduced. The Walloon Region is also investigating deposits, through a study whose preliminary conclusions are expected in early July 2023.

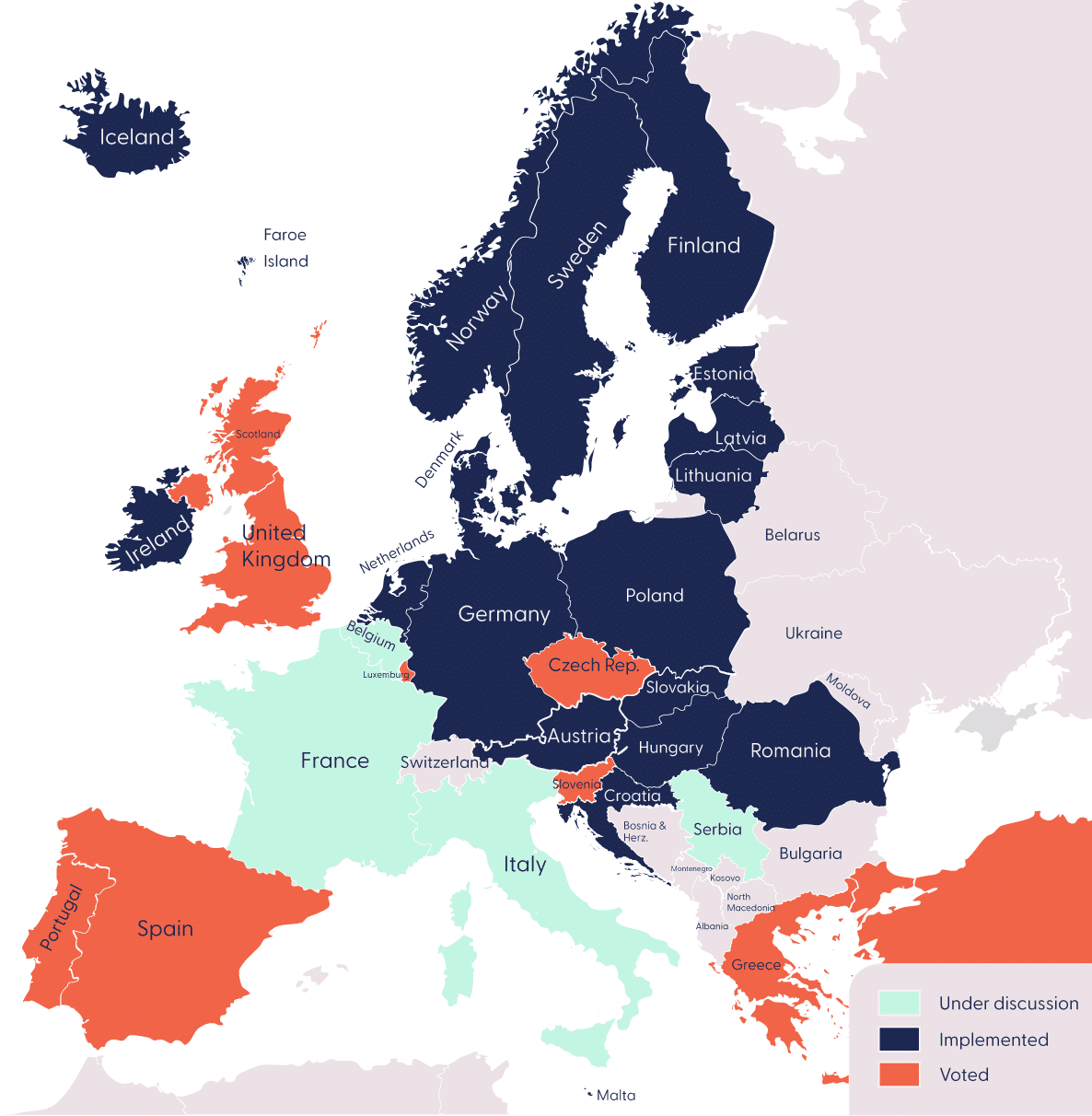

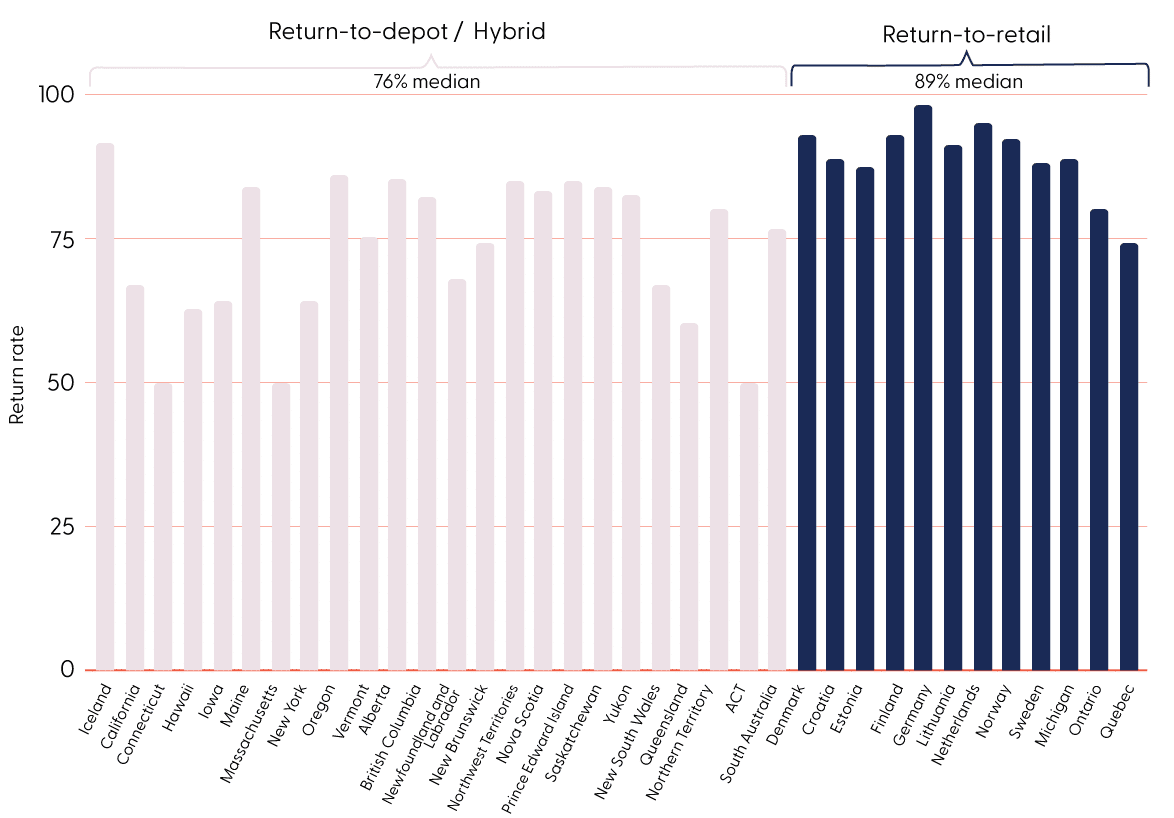

Deposit return systems (DRSs), with a return-to-retail (RTR-DRS) design, are widespread in Northern Europe (Figure 1). They have proven their effectiveness in reducing litter and increasing the return rate of high-value materials. The large number of examples in neighbouring countries provides sufficient benchmarks to actually implement an RTR-DRS by 2025.

On the other hand, the Belgian “Digital Deposit” proposal, which involves scanning two 2D codes before throwing packaging into the blue bag or “public blue bins”, still has to prove whether it can be implemented by 2025, or whether it can be implemented at all. This analysis presents the concepts of return-to-retail DRS (RTR-DRS) and the Digital Deposit proposal. It also assesses the advantages and disadvantages and the operationality of the Digital Deposit in the Belgian context.

Please note that most of the information about the specific design of the system for Belgium comes from the “Deposit Blueprint” carried out by PWC at the request of Belgian industry. This analysis will be updated when more information about Digital Deposit becomes available.

1) What are ‘Return-to-Retail’ DRS and ‘Digital DRS’?

In this section, we present RTR-DRS and the Belgian Digital DRS proposal and compare their respective costs, implementation timelines, impact on litter, return flow of high-quality material and potential reuse.

Description of the systems

In general, a classic deposit system is a system in which consumers pay a deposit when purchasing each beverage container. Consumers can get this deposit back in full by returning their empty containers to a collection point, after which the containers can be recycled or reused. In Europe, these collection points are mainly points of sale (supermarkets, kiosks, petrol stations, etc.), hence the name return-to-retail (RTR) DRS.

Seventeen European countries have introduced a RTR-DRS system or voted in favour of its introduction. In 10 other countries (Figure 1), there is ongoing discussion about the introduction of a DRS system. Belgium also has a similar system for certain reusable glass bottles.

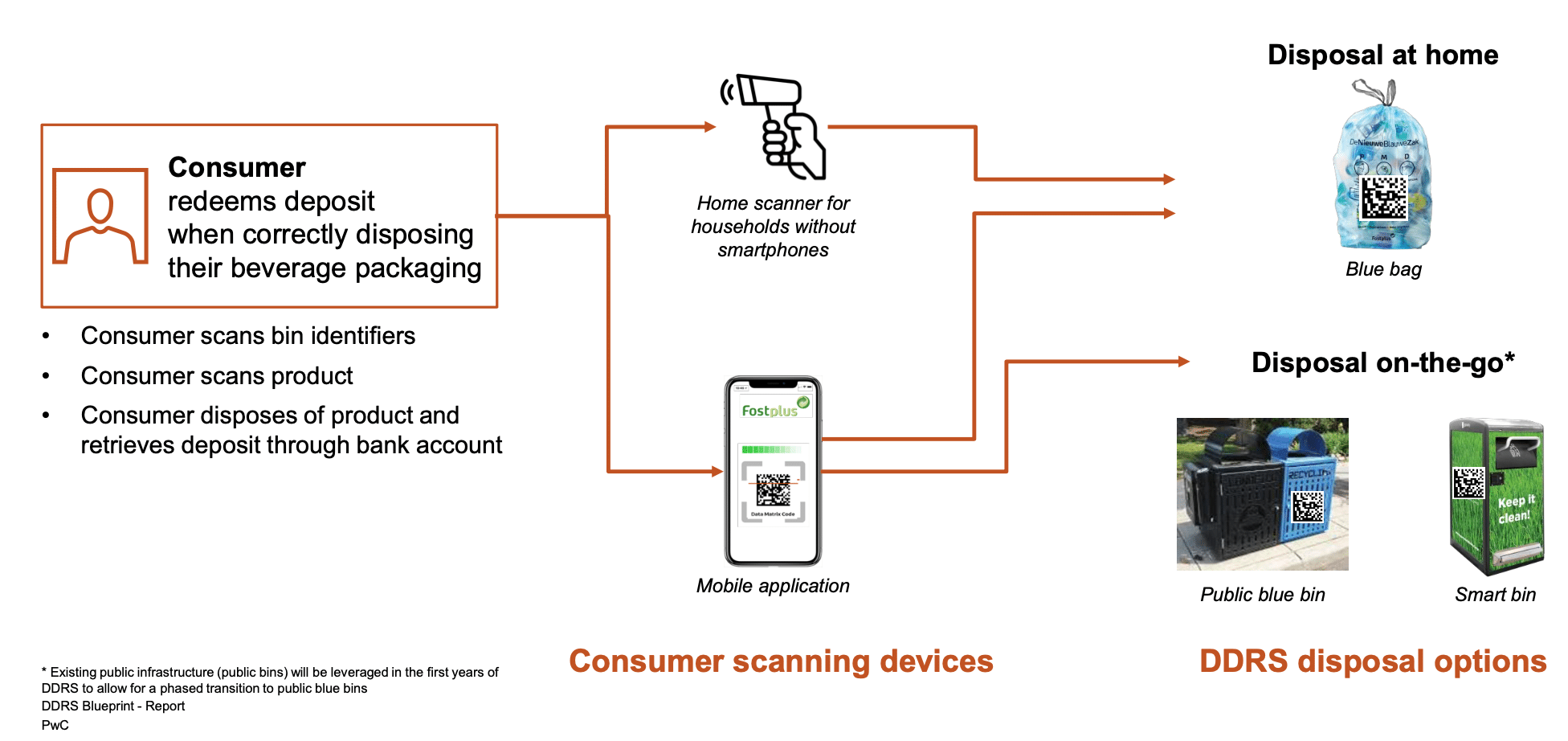

The Digital DRS (aka ‘QR-code system’ or ‘scanning system’) is an alternative proposal to RTR-DRS. As with RTR-DRS, consumers would pay a deposit when making a purchase. However, with a Digital DRS, beverage containers would be given a unique, serialised 2D code (Data Matrix or QR code) that is activated upon sale[1] (i.e. receives the deposit value). Various proposals for digital DRS have been investigated (see ResourceFutures, 2022). Here, we analyse the scenario proposed in the PWC study (Figure 2).

While consumers receive their deposit back by returning the packaging to a collection point under the RTR-DRS system, under the D-DRS proposal, consumers would have to scan the 2D code on each item of packaging with their smartphone or a home scanner and dispose of the packaging “correctly” in the designated bin, which also contains a 2D code that must be scanned, as shown in the proposed scenario (Figure 2).

Another difference is that consumers would dispose of their packaging in the existing “blue bag” (PMD collection at home) or in new public “blue” bins. This would mean adding 136,000 new bins to the existing public bins. Note that, according to the scenario in the PwC study (Figure 2), the blue bag and these new bins would also have a 2D code that could be scanned.

The PWC study also mentions “smart” bins in the chosen scenario, but these would only be used sporadically: 138 such bins are planned for the whole of Belgium, including 137 in Flanders and only one in Wallonia, compared to more than 136,000 traditional blue-coloured “public bins”. The use of the blue bag and simple ‘public blue bins’ confirms that packaging with a deposit is therefore together with non-deposit packaging (and non-food products) would be collected, whereas with RTR-DRS they are collected separately. PWC itself mentions the “potential contamination of waste streams” with the public blue bins (slide 27).

These differences would lead to different results in terms of costs, implementation timeline and effectiveness, which we explain in more detail below.

Expenses and savings

Costs: First and foremost, it is important to consider the costs of both systems, as the cost-benefit ratio of the system is essential to evaluating its success.

Various studies have concluded that RTR-DRS can be set up in a cost-effective manner for companies[2], and without additional costs for public actors, given the 100% producer responsibility. In a study According to OVAM’s 2015 study, the total annual costs of deposits on cans and bottles were estimated at 77 million euros, compared to revenue streams of 82 million euros. In this case, the estimated revenue exceeds the costs. The cost and impact study by the CE Delft (2017), commissioned by the Dutch government, suggests even higher potential benefits than costs with an RTR-DRS. When we look at systems that have been operational for some time, we see that the system functions well and is widely accepted by the various stakeholders. Retailers are compensated through administration costs, and the system can also generate traffic to shops from consumers who come to redeem their deposits. Reloop provides a clear overview of how all deposit-refund systems around the world are set up in practice, providing sufficient information about how the systems work in practice, with regard to operational and financial flows.

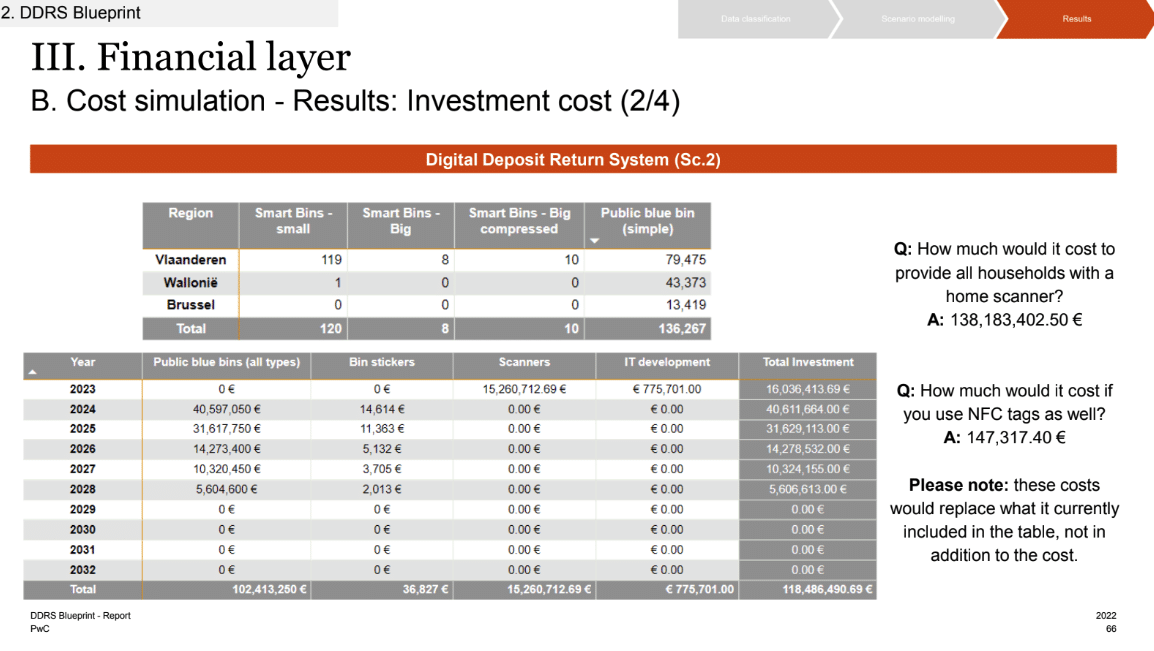

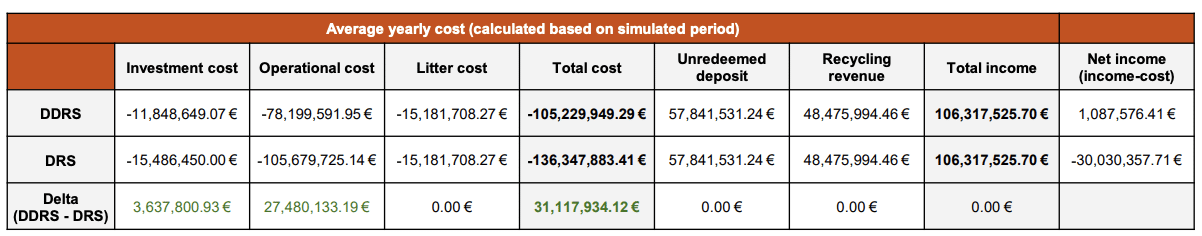

There is still insufficient information available for Digital DRS[3] to confirm that this system can also be set up in a cost-effective manner. Based on the PwC study, the Belgian packaging industry claims that its introduction would be cheaper. Firstly, however, it should be noted that the PwC study provides very little information about the calculations for both the QR code system and the traditional DRS, making it impossible to check them thoroughly, so the conclusions should not be accepted without further evidence. What we can verify is whether certain costs and revenues have been omitted or whether errors have been made in the calculations, insofar as the study is transparent about this. Even with such a limited analysis, it is clear that several elements in the financial layer (slides 56-90) of the study appear questionable. Among other things (Figure 3, slide 66):

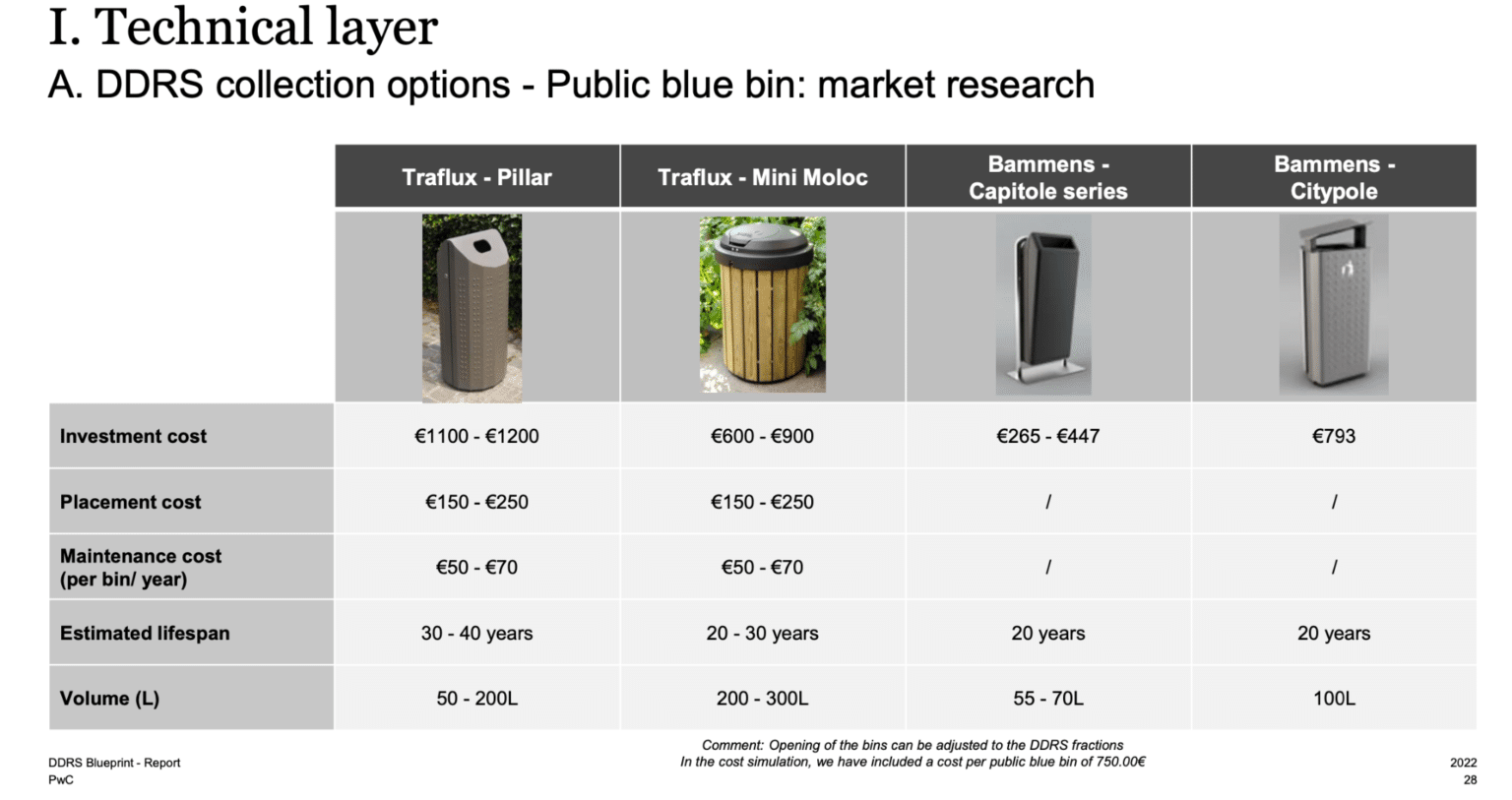

- Costs Traflux – Public blue waste bins (slide 66): The investment costs in the chosen scenario do not correspond with the market research conducted by PWC (Figure 4), slide 28). The investment and installation costs per bin ranged from €1,250 to €1,450, but PWC used a reference cost of €750 per bin. When the investment costs are corrected (using the lowest cost of €1,250), this leads to an underestimation of €68,133,500. When this underestimation is taken into account, the investment costs for the digital DRS amount to £186,619,990.69 (compared to an estimate in the PWC study of £118,486,490.69), which is higher than the investment costs of the RTR-DRS (€154,864,500), see slide 68.

- Costs of home scanners. In the DDRS scenario evaluated by PWC, the cost of home scanners would amount to €15,260,712.69, which corresponds to 554,935 scanners (€27.5/scanner). The number of home scanners required for all Belgian households would be 5,024,851 (138,183,402.5/27.5 – slide 66). In the evaluated scenario, therefore, only 11% of households have a home scanner. This seems to be an underestimate given the potential refusal of users to use smartphone apps, digital illiteracy (if home scanners were to solve this problem at all), people with disabilities, home scanners for families with children (so that they can also participate in the system, etc.). It is possible that some Belgian households may want a home scanner, even if they have the application on their phone. Furthermore, it is not clear that home scanners can bridge the digital divide. 11% coverage of home scanners therefore seems to be another underestimation of the costs.

- Operating costs in the PWC study are not detailed enough, so apart from asking a few questions, no further comments can be made. These include (slide 70):

- The transfer of sorting costs to the post sorting costs of bins in 2027, which seems to have been forgotten: in 2027, the annual pre-sorting costs (calculated for the “traditional public waste bins”) will simply disappear (more than €337,000), while in the same year the costs of post-sorting (defined on Slide 63 as) “Costs for sorting PMD fractions, based on EPR litter simulation. Applied to volumes collected via public bins (transition) and ‘public blue bins’.” will only increase by approximately €53,000. How can this be explained?

- What are the details of the maintenance/IT costs?

- Are the operational costs for cleaning public spaces missing?

This must be included in the calculation, as producers are now responsible for these costs.

In fact, with the same collection rates, recycling revenues would (c) likely be lower for Digital DRS, as material is more valuable when collected separately from other packaging and substances, preventing contamination and making it easier to use for new bottles and cans. PWC itself highlights this challenge (slide 27) without taking it into account in its cost analysis. An RTR-DRS is likely to generate tens of millions of euros more in recycling revenue compared to a digital DRS.

Timeline

Another decisive factor in choosing a deposit system is the speed with which it can be implemented. RTR-DRS requires an implementation period of 12 to 18 months[4] after the political decision. An RTR-DRS in Belgium could therefore be ready by 2025, provided that the plan for RTR-DRS is finalised in 2023. It can then be launched according to the timetable announced by Flemish Minister for the Environment Zuhal Demir.

There is no indication of the time required for the introduction of a digital DRS, as it has not yet been implemented anywhere. Due to the research required, the lack of insight into how the system should be set up in collaboration with other stakeholders, and the technological developments that still need to be made and implemented, it is unclear whether the entire digital DRS will be ready for the market at some point.

The Belgian packaging industry has until the end of 2023 to prove not only the technical feasibility of this system, but also whether it can actually achieve the set goals and is truly accessible to everyone. Pilot projects are seen as a crucial part of demonstrating the potential implementation, but so far, previous pilot projects launched by the packaging industry in Belgium to reduce litter have not been effective and have taken years to test, causing significant delays in the decision-making process. This is the case, for example, with the Prime de Retour in Wallonia and the ongoing Click reward system. The city of Antwerp has even recently stopped using Click, given the high costs and the lack of a reduction in litter.

As regards pilot projects involving digital DRS, only small-scale pilot projects have been carried out (in Dublin and Conwy[5]) of a few hundred households and for less than a month. They were by no means representative of how a system would function on a national scale and in the long term. Pilot projects typically take a long time, and given all the elements that still need to be proven in terms of the feasibility, accessibility and effectiveness of the digital DRS, pilot projects at this stage can realistically only provide part of the answer to the question of whether the digital DRS will be ready for implementation in 2025. All research to date emphasises the low market readiness of digital DRS (see ResourceFutures, 2022) and the long time it would take to adapt production (PwC study, slide 12).

And it cannot be the case that the industry tries to further delay the introduction of a system in Belgium. As Minister Zuhal Demir stated on Wednesday 18 January before the plenary session of the Flemish Parliament, “the bottom line is that a deposit system will be introduced in 2025” and that “if the pilots are not profitable, then the classic system will be implemented”. The pilots will be evaluated by OVAM, together with a sounding board group comprising social stakeholders such as representatives of consumer organisations, municipalities and environmental associations.

Effectiveness of the system

It is not enough to consider whether the digital DRS can be introduced within a certain time frame. It is also essential to ensure that the objectives for which deposit systems are designed are actually achieved. That is to say: reduction of litter, increase in the collection of high-quality material, transition to reuse systems. In the PWC study does not discuss the effectiveness of the system in relation to these elements, but simply assumes that the effect is comparable to that of a traditional DRS. However, the design of a traditional DRS is completely different. Furthermore, the PwC study does not address the question of whether digital DRS actually enables reuse, even though the intention of the future Packaging and Packaging Waste Regulation is to encourage reuse for beverage packaging.

Effect on litter

A study by CE Delft[6], commissioned by the Dutch government, looked at international data on the effects of DRS and estimated the potential reduction in litter for small plastic bottles and cans to be between 70 and 90%.

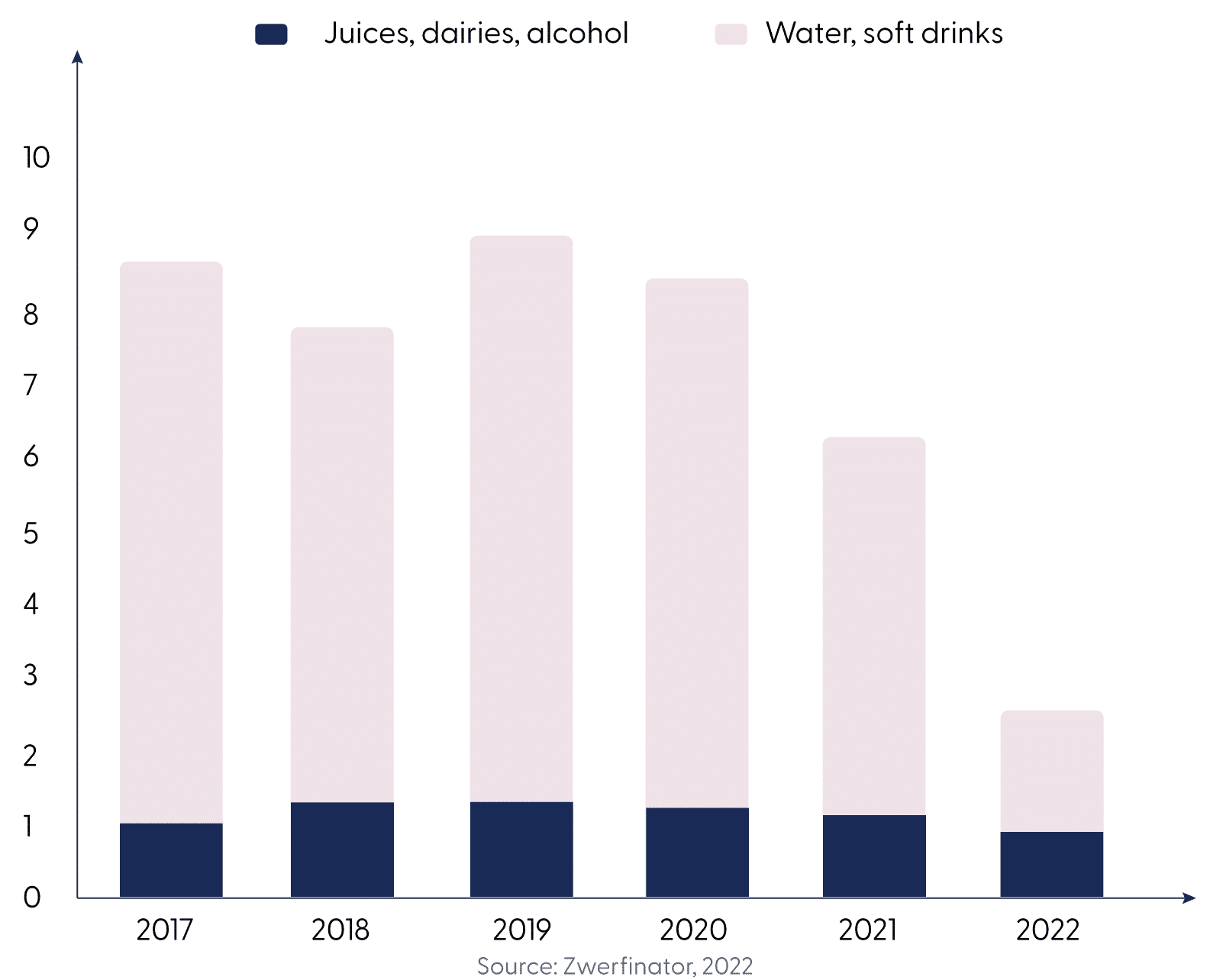

Just one year after the Dutch system was expanded to include small plastic bottles, Zwerfinator Dirk Groot recorded 76% fewer small plastic bottles per kilometre (Figure 5[7]).). Please note that there are still old plastic bottles without a deposit in litter, illegally imported plastic bottles without a deposit, and plastic bottles of fruit juices or dairy products that are exempt from the deposit obligation.

When these factors are corrected, the actual effect of the deposit a reduction of 85% in small plastic bottles in litter. The Dutch Ministry of Infrastructure and Water Management estimated a 53% reduction in small plastic bottles in litter compared to 2020. The effect of RTR-DRS is further supported by monitoring in Denmark, which shows that cans with a deposit are 90% less likely to end up in the environment than cans without a deposit.

Meanwhile, no study or monitoring has demonstrated the effect of the digital DRS on litter. Although we can expect its effect to be better than no system at all, it cannot be assumed that it would be the same as with an RTR-DRS, as was done in the PWC study (see Table 1). The impact of the digital DRS would largely depend on consumer participation and the accessibility of the system for consumers[8], and there are many questions and uncertainties about this (see next section).

Effect on the collection rate of high-quality material

Countries with RTR-DRS systems have the best collection rates for deposit-refund packaging (Figure 6).

Most traditional DRS systems in Europe are already meeting the European SUP Directive’s target of 90% separate collection for disposable plastic bottles by 2029. The Netherlands (for large plastic bottles) and Germany even achieve separate collection rates of over 95%. There is currently no verified information on the percentage of separate collection of disposable plastic bottles in Belgium, but it is generally assumed that the target can only be achieved with a deposit system.

With RTR-DRSs, the collected waste material is of very high quality, as the packaging is completely isolated from other (non-food) material that could contaminate the waste stream. This enables ‘bottle-to-bottle’ and ‘can-to-can’ recycling, which is important to reduce the CO2 impact of those packaging.

With a digital DRS, it remains to be seen what percentages of separate collection can be achieved and whether the EU target of 90% is within reach. With this system, deposit packaging would still be collected together with non-deposit packaging, either in the blue bag or in the ‘public blue bins’, which leads to contamination risks. Currently, no recycled bottles or cans are made from materials originating exclusively from a PMC system, such as the blue bag. For plastic, this is due to safety requirements (EFSA, 2012), and for cans, to technical feasibility issues. The same would then apply to the digital DRS, as the packaging remains in the same stream. This is essential in the transition to a truly circular and more local economy, to which Fost Plus itself indicates that it wants to make the transition. Transition to reuse

More high-quality recycling is obviously a step towards a more circular economy. However, Belgium, like all other countries, must work towards a shift towards more reusable packaging. By keeping packaging in blue bags or, even more so, in ‘public blue bins’, an economy based on (lower quality) recycling rather than reuse is promoted. In the current system, beverage packaging is mixed with other (non-food) waste, making the transition to reuse much more complex because the packaging is at risk of being damaged or deformed. The new ‘ Packaging and Packaging Waste Regulation’ proposed by the European Commission on 30 November 2022 makes it clear that all Member States are expected to transition to more refillable packaging by 2030. RTR-DRSs enable direct reuse systems for beverage packaging. This is already the case in Belgium for glass beer bottles. The system can easily be scaled up for plastic bottles and cans. This also applies to some plastic bottles in Germany (” Mehrweg“).

The deposit system that will be set up in Belgium should facilitate the transition to reuse. Systems based on household waste collection are currently not suitable for refillable products, and adding unique codes to plastic bottles and cans does not change this.

2) Consideration of the digital DRS: uncertainties of the system

In order to assess whether digital DRS could be a suitable alternative to traditional DRS, we need to determine whether it can achieve the same – or better – results at the same – or lower – cost. However, there are still many unanswered questions that need to be taken into account when comparing the two systems.

Accessibility for consumers

Consumer accessibility is key to high participation in DRS. In a study published by Fost Plus video it has been said that the Digital DRS is more convenient for consumers because they can dispose of packaging at home. However, the fact that the system is technology-intensive – using a smartphone app, scanning 2D codes, linking to a bank account – raises the question of the accessibility and inclusiveness of the system. Fost Plus claims that “everyone can get their deposit back”.

But what about, among others, households on a modest budget, children, people with disabilities, the elderly or homeless people who could be excluded from this system if they do not have access to smartphones (with the specific Digital DRS app) or a bank account? In Flanders, in 2021, 46% of the population didn’t have “basic digital skills”. This means that one in two Flemish people would be unable to access this digital system.

Home scanners are proposed as an alternative to smartphones. However, these would not be suitable for “outdoor use”, which would exclude digitally illiterate people from a large part of the system. Furthermore, it is not even certain that digitally illiterate people would be able to use the scanners. Many registration steps would still be required that require digital skills (see slide 14), such as creating a profile on the D-DRS website and linking a bank account. The question is also whether the home scanners would need an active internet connection to work, which approximately 1 household out of 10 has no access to (up to 31% for households over 65 years of age). In response to Demir’s announcement, Testaankoop stated that it was opposed to the Digital DRS proposal because it “excludes people” and that people without smartphones would be “victims” of such a system.

Data privacy

With the digital DRS, consumers would have to share personal data (e.g. entering your name and address to create an account, linking a bank account, sharing your geolocation). Apart from the issue of digital literacy, this raises questions about the privacy of data and consumers’ willingness to share such information. The industry will have to demonstrate that it can effectively prevent any current and future abuse of the system (” function creep“) and that it can actually protect the system against any type of cyber attacks (such as a hacking of the system to steal individual 2D-codes to then sell them massively).

With RTR-DRS, anyone can redeem their deposit by returning the packaging to shops[9]without having to share any data. There are also solutions for people who cannot go to these points of sale, such as delivery services that take back deposit packaging upon delivery.

Fraude

For example, consumers could redeem the deposit on all newly purchased beverage containers a) in the “public blue bin” next to the supermarket when they leave the shop, or b) when they return home from shopping. Consumers would then be able to get their deposit back without having consumed the beverage. The packaging could then still end up in nature. These problems already exist with the Click-bins [10] in the streets (RTBF, 2022). It is important to note that this does not only come from malicious users, but also from honest consumers who encounter a full public rubbish bin when disposing of their packaging.

One could also imagine people taking photos of all the unique codes on a supermarket shelf, waiting a few days – until the packaging has been sold and the code activated – and then scanning the photo of the 2D code to get their money back. Photos of the codes could also be taken on the production line.

The aforementioned cyberattack is also a form of fraud, whereby some or all unique codes could be illegally disclosed, compromising the entire system.

3) Operationality: when would a digital DRS be ready for implementation?

Below, we provide an overview of certain elements that require further research and technological innovation before a decision can be made on the introduction of a digital DRS. Please note that there may be other factors that we cannot foresee at this time, but which may come to light during the further development of the digital DRS.

Printing and activating unique 2D codes for all manufacturers and retailers

The core of the digital system is the assignment of a unique serialised 2D code on each package in question. The PwC study specifically opts for Data Matrix 2D codes, an alternative to QR codes. These codes can be printed in a smaller format than QR codes because they contain less data. However, many smartphones do not have the built-in functionality to scan Data Matrix codes, so a third-party app is required [11] to scan this code.

While it is technically possible to print unique 2D codes on labels that are then applied to packaging (e.g. plastic or glass bottles), it is much more complicated to do so directly on the packaging without incurring significant adaptation costs and without losing speed.

Although printing unique 2D codes is technically possible on labels that are then applied to packaging (e.g. for plastic or glass bottles), it is much more complicated to do this directly on the packaging without incurring significant modification costs. In the case of cans, for example, it is not possible at this stage to carry out such printing without significant loss of speed on many production lines (resulting in rising costs per unit produced[12]).

The PwC study mentions significant adjustment costs, ranging from 1 to 11 million per producer (slide 12). This does not take into account the difference in cost structure for smaller producers.. They may have higher unit costs because they cannot benefit from the economies of scale or advanced printing machines that large producers have easier access to. The conclusion is that it is currently not feasible to apply a unique 2D code to beverage packaging without significantly increasing production costs. It remains unknown what the effect of these higher production costs would be on the price for the consumer.

The issue of products manufactured in other countries still needs to be addressed: how can these be included in the deposit system? For cans, for example, producers may have to rely on a few producers who have invested in new technology (still with a lower production speed) or they may have to stop production for the Belgian market. This raises the question of whether a digital deposit system would be compatible with the European internal market. With regard to simple 2D codes, GS1 – the global organisation that standardises coding methods – states that 2D codes will not be widespread until 2027 – these are generic 2D codes for product lines and not even unique codes for each product. GS1 also mentions the many obstacles that still stand in the way of standardising these codes.

The problems with 2D codes are not only related to printing the unique code, but also to activating it in retail outlets. According to the PwC study (slide 13), the 2D codes would be activated at retail checkouts. But what about self-checkouts? Should consumers activate the code themselves? And what happens if they don’t? But what about resellers’ packaging? For example, a night shop that buys beverage packaging. How can we ensure that activation does not take place too early, thereby increasing the aforementioned fraud possibilities? This needs to be further elaborated to avoid activation problems between retailers and resellers.

Dependence on municipalities for public space and home scanners

The current proposal of the industry for a digital DRS involves placing ‘public blue bins’ outside supermarkets (mainly ordinary open bins that are painted blue, and 138 ‘smart’ bins). This would require additional public space tp be used (parks, city centres, shopping areas). The involvement and support of municipalities are essential for the entire “on the road” part of the system (see slide 40). Municipalities and intermunicipal waste companies in the Netherlands protested vehemently when the industry planned to collect deposit cans in public spaces.

The Federation of Flemish Municipalities, Association of Flemish Cities and Municipalities (VVSG), warned that “if a deposit system is introduced, the total cost of a deposit system must be borne by the producers. Under no circumstances should local authorities be responsible for additional costs caused by a deposit system. The VVSG is not in favour of a scenario in which returns are mainly handled through the public domain and responsibility is placed on local authorities.” (VVSG, 2022).

The dependence of municipalities does not end with the simple installation of additional public rubbish bins. According to the PWC study, they could also be responsible for the ” registration and distribution” of home scanners to households (slide 14). Municipalities could also be responsible for managing consumer accounts, such as “handling citizens’ moves” (slide 52). This too places an additional burden on municipalities, which is unnecessary within an RTR-DRS.

Investments in system-specific infrastructure for 2D codes

Conventional deposit-refund systems already have a robust and well-functioning back-end system. This system already exists in many countries and provides examples of the best-performing systems. With a digital counter, new research and specific investments are needed to make the entire system operational.

Let’s take fraud as an example of the potential complexity of the system. To prevent fraud, a third scan[13] of the packaging in the sorting centres may be necessary to confirm that the packaging has indeed been collected. It would require significant investment and a considerable amount of time to adapt the existing infrastructure. These investments are not necessary with an RTR-DRS, and therefore these additional costs must be taken into account.

Conclusion

Once the digital DRS has been properly developed and tested, certain functions can be added to the RTR-DRS infrastructure to enhance the significant environmental benefits that RTR-DRS already offers. However, this may take years, as the technology is not yet ready. [14]. In addition to the feasibility of the system, there are also many doubts about the actual effects of Digital DRS – especially in comparison with RTR-DRS, whose effects have been proven.

With the introduction of a deposit system on all plastic bottles and cans in Belgium planned for 2025, and after years of fruitless attempts by the industry to significantly reduce litter, Belgium urgently needs a system that is accessible to everyone, effectively reduces the amount of packaging in litter and closes the loop by encouraging high-quality recycling and reuse. Return-to-retail DRS is the only system that has proven to address these issues. It is highly unlikely that the digital DRS will prove to be a viable alternative for implementation in 2025 in the course of 2023.

Sources

- See PwC, DDRS Blueprint – Consolidated Report, 27 september 2022, dia 51 ↑

- Voir presentatie Norwegian System (Infinitum), speech by the management ↑

- Because the digital safe has never been used before. In the United Kingdom, only a few small-scale pilot projects have been carried out. ↑

- Based on examples in other European countries (see Reloop Global Deposit Book for data) ↑

- See PwC study, slide 152, note that the Whitehead pilot was not a deposit pilot, but a pilot with a reward system. ↑

- CE Delft, 2017. Kosten en effecten van statiegeld. Commissioned by the Dutch government ↑

- Zwerfinator, 2022. Onderzoek Drankverpakkingen 2017-2022H1 ↑

- Eunomia, 2022. Deposit Return in the Netherlands: An assessment of the Afvalfonds proposal for beverage can collection in the public domain ↑

- It should be noted that most deposit schemes have a take-back obligation, so that consumers can return their packaging to all points of sale (with the exception of small retailers). ↑

- Reward system tested by Fost Plus. ↑

- See ResourceFutures, 2022, Digital DRS Feasibility study Phase 1, p11 ↑

- Based on PwC study and information from can manufacturers. ↑

- See Resource Futures (June 2022), D-DRS Feasibility Study – Phase 2: End-to-end system design, slide 10 ↑

- See Resource Futures (Juin 2022), DDRS Feasibility Study, Phase 2: End-to-end system design ↑

Related Tags

Where and why: financing of the plastic waste trade

In our previous article, we provided a wide overview of the size and importance of international plastic waste (PW) trade. Subsequently, in this piece, we will shed light on why plastic waste trade is such a profitable sector and which are the incentives to perform this business outside of legality.

Court of Rotterdam sentences several people for illicit plastic waste trade from the Netherlands

On Friday 8th of August 2025 Dutch news outlets echoed about a sentencing on plastic waste smuggling from the Netherlands to various non-EU countries. NL Times, AD, local news outlets, and the Dutch Inspection (ILT) reported the criminal sentencing of 4 people and 3 companies for illicit plastic waste trade, with one of them being also charged with money laundering.

Belgian packaging industry already saved 465 million € in litter fees – at our expense

The Belgian packaging industry is outraged by the introduction of a new €102 million litter levy. But it conveniently forgets that its effective lobbying has already saved it no less than €465 million. This sum has been gained at the expense of local authorities and society. This levy is due to be approved today by the Walloon Council of Ministers. Fair Resource Foundation delves into the figures.